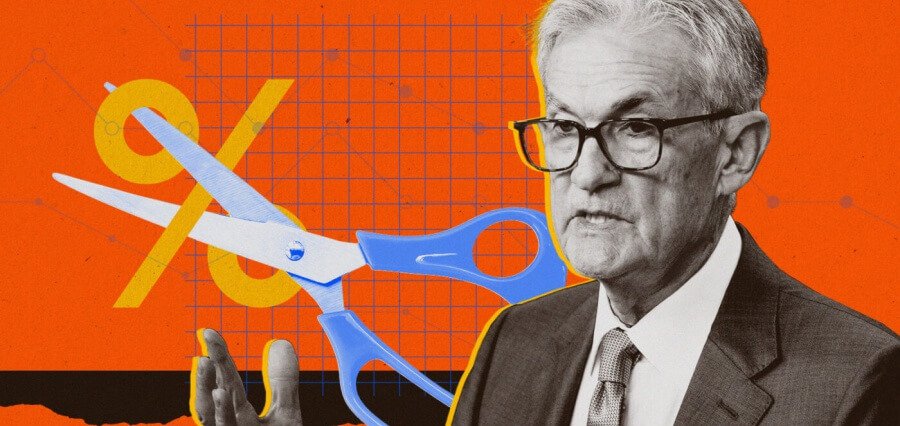

While National Association of Realtors settlement might be only the first in a wave to be felt in the Southwest Florida and many other states’ real estate market, the Federal Reserve’s surprise 0.5% rate cut last week has brought a question on: Will it further lower mortgage rates which are already on a fall?.

The Federal Home Loan Mortgage Corp. said the average fixed-rate mortgage declined to 6.09% as of September 19 – the lowest level since February 2023, having slipped from 6.2% in the preceding week and substantially lower than the peak of 7.79% last fall. The lender shares on its website that the “decline in mortgage rates is reviving purchase and refinance demand for many customers.”. Though not especially reflective of the Federal Reserve’s moves, mortgage rates represent the first time in more than four years that the central bank has cut a rate, and those cuts should impact the housing market.

Thus, although the slide in mortgage rates of late was widely seen as long overdue, further reductions will likely push housing activity. PJ Smith stated, ” While mortgage rates don’t always mirror the Federal Reserve’s actions, we’re hopeful this’ll set things in a positive spin for both our local and national housing markets.” This may ultimately lead to greater refinancing and recasting of existing loans.

Smith believes that the buyers who were priced out of the market due to high costs of insurance and mortgage rates may now re-enter. “Sales have been somewhat sluggish this summer, which may just be a return to normal seasonal patterns rather than the pandemic-driven year-round activity. First-time homebuyers will undoubtedly benefit the most, and it’s absolutely important that our agents communicate to consumers the advantages of owning versus renting, helping to get people started in building equity.”

Lower rates might push more conservative buyers back into the market, boosting demand and competition.

Mortgage Lending

On the lending side, Tom Lytton, Executive VP and Chief Credit Officer at FineMark National Bank & Trust in Naples, believes mortgage rates will continue coming down, though they aren’t necessarily on lockstep with the Fed’s cuts. He says the Fed controls primarily the discount rate that banks pay, but obviously that influences their funding cost. Mortgage rates also depend on other broader economic factors, such as the 10-year bond market and the performance of mortgage-backed securities.

Image used for information purposes only. Picture Credit: https://static.therealdeal.com/